List of big Gurus posts in this blog post:

1/ Brett Steenbarger Phd Psychology

2/ Dr. Doug Hirschhorn PhD Sports Psychology

3/ Steve Palmquist

Interview By Kirk

1/ Credits: Dr. Doug Hirschhorn PhD Sports Psychology:

At the moment I am currently on retainer as the trading psychology coach for several major banks (i.e. Credit Suisse, Deutsche Bank)

- . I am also on retainer with several multi-billion dollar macro and fixed income hedge funds

- . My coaching practice focuses on improving the performance of elite traders, large portfolio managers and principals of hedge funds.

Dr. Doug Hirschhorn: Some of the key lessons I learned were:

- Making money is easy, keeping it is hard

- You can have a 1000 reasons to get in a trade, but you only need 1 reason to get out

- Focus on the process (quality of your trades), not the outcome (profits/losses)

- Know what your edge is (what your pitch looks like) and trade only when you have edge (swing only when your pitch appears).

2/ Brett Steenbarger Phd Psychology

1. Behavior is patterned.

2. Your trading patterns reflect your emotion patterns.

3. Change begins with self observation

4. Problem patterns tend to be anchored to particular states. (When you enter a particular state thru emotional, physical, or cognitive activity, you tend to activate the behavioral patterns associated with that state.)

5. Our normal states of mind, which define most of our daily experience, lie within a restricted range of our possibilities. (Your immersion in daily routine keeps you locked in routine mind states)

6. Most trading occurs in a limited range of states, trapping traders in problem patterns. (Traders tend to place greater emphasis on the data they process than on the ways in which they process those data.)

7. People in general, and traders specifically, enact solutions as well as problem patterns.

8. Eliminating emotions is not necessarily the secret to improving trading. (Traders can utilize positive emotional experiences to identify constructive solution patterns and to create an anchoring of new, positive patterns.)

9. Success in the markets often comes from doing what doesnt come naturally.

10. The intensity and the repetition of change efforts are directly responsible for their utlimate success.

11. Trading success is a function of possessing a statistical edge in the markets and being able to exploit this edge with regularity.

-------------

Compared to Van Tharp's books, Dr. Steenbarger takes an entirely different approach. Where Van Tharp focues on Position Sizing and Positive Expectancy systems, Dr. Steenbarger focuses on proper self-monitoring and self-coaching tips to improve performance over the daily uncertainty of Wall Street.

Combining Van Tharp & Brett Steenbarger's lessons, below are some commonly misunderstood facts of financial speculation:

1) It's not by making large profits that money is made over time. It's by consistently keeping losses small in relation to profits.

2) Making Money and Being Right are at opposite ends of the performance spectrum, and --- very surprisingly to most --- most professional traders admit their primary job is to minimize losses, NOT focus on being right. Why? Minizing losses (well over 50% of the time losses can't be avoided) ensures their average winner will be greater in relation to the average loser.

3) No one knows FOR SURE how much profit any trade is likely to make. Fortunately, it is possible to know THE INITIAL RISK a trader is willing to lose.

4) Projection of future prices are only a BEST GUESS, never a 100% certainty.

5) Top traders only control three things all the time: Initial Risk, Exits, and EMOTIONS...

Most professional traders keep emotions in check, and most admit that an emotional trader is a Dangerous Trader. I'm happily surprised to find Dr. Steenbarger support a different view.

Steve Palmquist

1) There is no magic to trading. It is about putting the odds on your side and not trading unless they are. This sounds simple, but it takes a few years to get good at it.

2) And like most things, while you are learning it is best to work with someone. The learning time is long because traders have to see how things behave in different markets, and learn to trade the odds and not their feelings. The market will not adapt to us, we must adapt to it. ( asr: by this time New traders lose money ).

3) Successful trading is not about predicting what the market is going to do. It is about knowing how to react to whatever it does.

(asr: this calls for have Price levels ahead a) if CL drops 3% when SP/EUR drops 2% what to do next day morning , b) have on Daily chart what was SP/EUR level last few days when CL was at bottom levels , this gives idea what LOW values of SP/EUR CL tolerate and Rise from that BASE level )

4) Trading is a statistical business where it is important to manage risk. Every trading system has a certain percentage of winners and losers.

5) Successful traders have a toolbox of well tested trading patterns, and use the ones most appropriate to the current market conditions.

The market will not adapt to us, we must adapt to it. Using the same trading technique all the time can be ineffective because the market environment is always changing.

Trading range markets, bullish markets, and bearish markets favor different tools. The Timely Trades Letter provides insightful market analysis and powerful trading patterns like

- pullbacks,

- retracements,

- candlesticks,

- accumulation, distribution,

- overbought, oversold,

- topping and bottoming, and (asr: for CL Topping in OverBought condition calls for BUY puts/Shorts )

- continuation patterns ( important)

Fully tested and evaluated trading patterns are an important part of the successful traders toolbox. Testing trading systems does not guarantee future results, but it provides the trader with insight into what is likely to work and how to use it.

Trading a system that has never been tested and evaluated makes little sense. We focus on testing different systems in a variety of market conditions and with different volume patterns and a variety of filters in order to develop a clear understanding of how each system has worked in the past.

-----

source Kirk news letter email

Roy felt that successful traders:

1) are very solid with what he called the “basics” (tape reading, execution, preparation for the trading day),

2) have discovered the trades that fit your personality and became excellent at those and

3) realize that successful trading is about pulling a small bucket of profit water out of the market well multiple times (in other words they are not greedy).

Mike’s top 3 were:

1) a passion for trading,

2) the willingness to admit you are wrong in your bias and to change your bias or terminate a losing trade and

3) to work really hard to become better each day.

Gman (who had actually had a list of 7 characteristics which were really interesting, but I’ll share his top 3):

1) hard work and preparation,

2) an ability to recognize what trades truly work for you and to STICK with them and

3) calmness in the midst of market volatility.

Unglamorous as it may sound, it looks like the clear winner is hard work and learning the basics. Should this be that big of a surprise? Wasn’t it Thomas Edison who said ” genius is 1% inspiration and 99% perspiration”? But it is interesting to note that two of the three put a very high premium on recognizing your trading strengths and focusing on those types of trades primarily.

-----------

-------------

asr: we are trying to capture all that info for CL like Reuters , Bloomberg , businessweek.com and archive it .

Available trading information far exceeds one’s capacity for making basic trading decisions, so one can only attend to some of this data. Limited capacity is a major factor in trading success and in understanding stress.

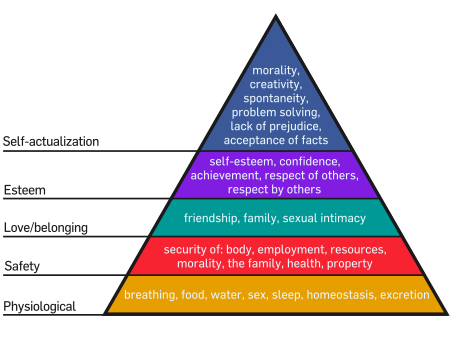

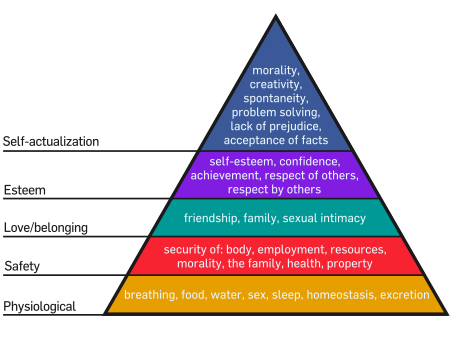

Three factors are essential to successful trading:

1. a healthy psychological profile,

2. the ability to make accurate decisions from a large amount of information, and

3. money management and discipline.

------------